Denmark Breaks the Mold: €1B Tri-System Air Defense Moves NATO Procurement Logic & Hedges NATO

Fast-tracked acquisition of NASAMS, IRIS-T SLM, and MICA VL compresses 60-month cycles into 24, signaling a wider shift in doctrine toward operational delivery over procedural orthodoxy.

On 10 June 2025, Denmark’s Ministry of Defence officially confirmed a €6B fast-track acquisition of three short-range ground-based air defense systems from Diehl Defence (Germany), MBDA (France), and Kongsberg (Norway).

The decision was approved by a unified parliamentary defense settlement group and is financed via the Accelerationsfonden. The systems will be operational by 2026 to address urgent security needs. This analysis is based on verified public statements from the Danish MoD and aligns with Großwald’s structured intelligence framework.

Copenhagen’s simultaneous acquisition of NASAMS, IRIS-T SLM, and MICA ground-based air defense systems breaks European procurement orthodoxy to address a critical 20-year capability void. The decision prioritizes rapid deployment over traditional cost-efficiency models, reflecting NATO Article 3 modernization pressures and evolved threat assessments post-February 2022.

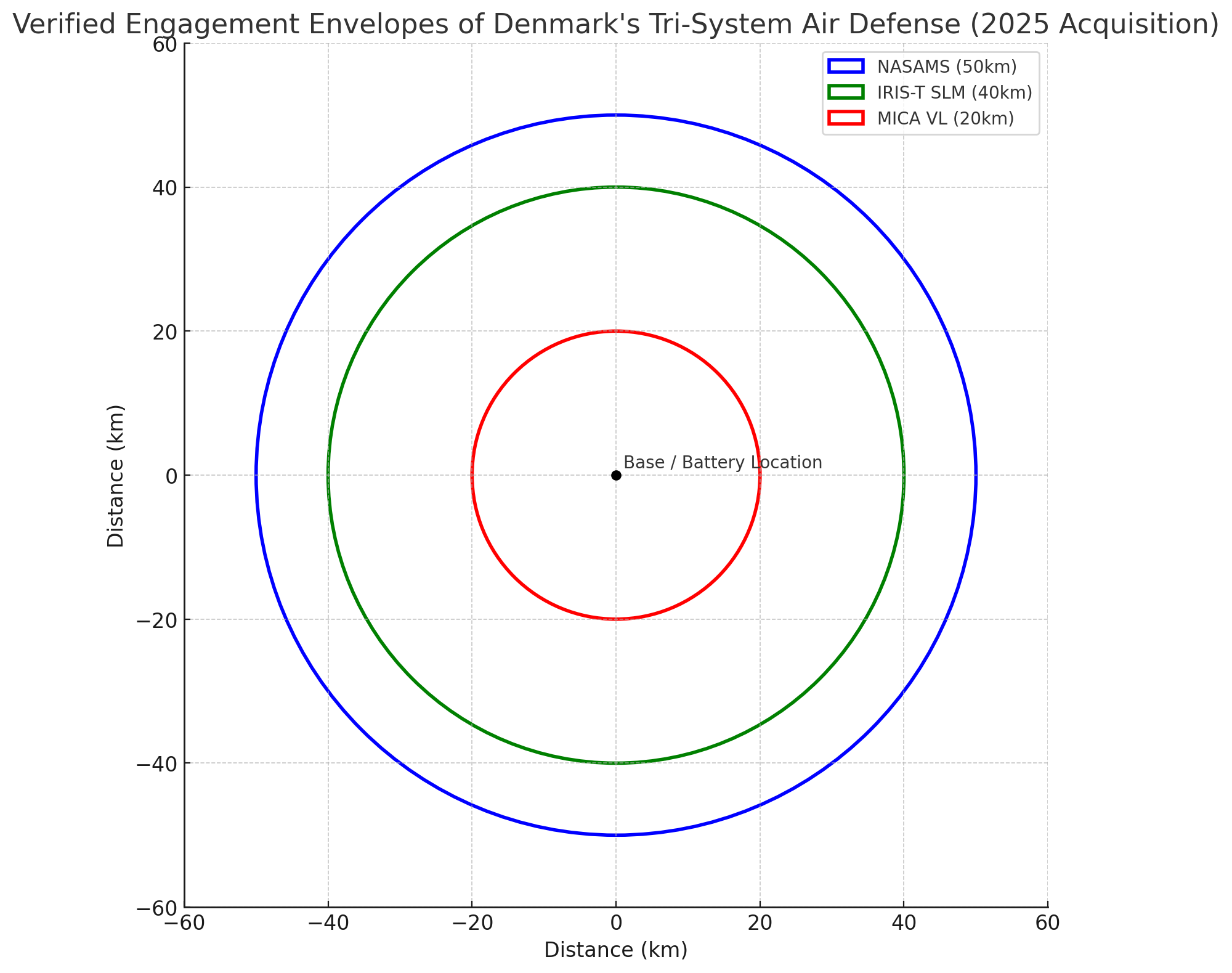

This layered mix provides complementary engagement envelopes, sensor diversity, and redundancy across radar, infrared, and electronic warfare domains—deliberately selected to hedge against saturation, spoofing, and single-point failure.

Capability Gap Analysis

Denmark eliminated ground-based air defense in 2004, relying on F-16 patrols and allied umbrella coverage. Russian precision strike demonstrations in Ukraine—particularly Kinzhal hypersonic and Shahed-136 swarm attacks—exposed fundamental vulnerabilities in point defense architectures. Baltic Sea reconnaissance intrusions by Russian aircraft further highlighted Denmark’s strategic exposure along NATO’s northern approaches.

The 2026 IOC timeline compresses normal European procurement cycles from 60+ months to 24 months, necessitating parallel rather than sequential system integration.

Technical Assessment of Denmark's Tri-System Air Defense

System Capabilities Matrix

NASAMS (Kongsberg/Raytheon)

- Range: 50km (AMRAAM-ER)

- Integration: NATO Link 16 native

- Combat proven: 94% intercept rate, Ukraine operations

- Sensor architecture: AN/MPQ-64F1 X-band radar

IRIS-T SLM (Diehl Defense)

- Range: 40km

- Seeker: Imaging infrared terminal guidance

- Counter-countermeasures: Advanced against flares/chaff

- Production capacity: 500+ missiles annually (Schrobenhausen)

MICA VL (MBDA)

- Range: 20km

- Guidance: Dual-mode active/passive radar

- Electronic warfare resilience: Home-on-jam capability

- Vertical launch: 360° engagement envelope

The map above visualizes the verified engagement envelopes of Denmark’s tri-system air defense architecture:

- NASAMS (Kongsberg/Raytheon): ~50 km range (outer blue ring)

- IRIS-T SLM (Diehl Defence): ~40 km range (middle green ring)

- MICA VL (MBDA): ~20 km range (inner red ring)

These values are based on manufacturer specifications for the deployed missile variants (e.g., AMRAAM-ER, IRIS-T SLM, MICA VL). The concentric layering illustrates the complementary coverage logic: NASAMS for wide-area defense, IRIS-T SLM for mid-range interception, and MICA for close-in, 360° vertical engagement.

Operational Integration Challenges

Tri-system deployment requires unified battle management command (BMC2) architecture linking incompatible datalinks and engagement algorithms. Denmark must establish:

- Common tactical picture integration across three sensor networks

- Deconfliction protocols preventing fratricide between overlapping engagement zones

- Standardized rules of engagement accommodating different missile flight profiles

- Unified logistics train supporting three distinct ammunition supply chains

Strategic Implications

NATO Burden-Sharing Dynamics

Denmark’s procurement distributes €1.2B across Norwegian, German, and French defense industrial bases, supporting Alliance cohesion while avoiding single-nation dependency. The approach addresses EU Strategic Compass requirements for EDIB diversification while maintaining transatlantic ties through NASAMS’ Raytheon missile component.

📌 Perspective from Großwald Doctrine Analysis

“Strategic autonomy begins with enablers—ISR, logistics, and missile defense—not communiqués.”

– Großwald, Friedensgutachten 2025 Commentary

Denmark’s tri-system architecture—despite national procurement—is structurally aligned with this logic. Its redundancy, multinational sourcing, and compressed timeline reflect enabler-first thinking critical for future NATO-EU capability coherence.

Procurement Model Innovation

📌 Procurement Agility Matters

“EO 14267 codifies speed in U.S. defense acquisition. Europe, in parallel, is institutionalizing deterrence—through law, funding, and posture—with growing momentum. The challenge now is tempo.”

– Großwald Policy Desk, EO 14267 and the Procurement Divide

Denmark’s fast-track acquisition strategy echoes this shift: capability now takes precedence over process. Its model may inform discussions on a European OTA analogue.

The simultaneous selection abandons competitive procurement’s theoretical cost optimization for operational risk mitigation. Three-system redundancy provides:

- Supply chain resilience against production disruptions

- Technical redundancy against single-point system failures

- Accelerated learning curve through parallel operational experience

- Enhanced negotiating position with individual suppliers

Operational Readiness Impact

Denmark’s model reflects a deliberate shift in European defense logic—from optimized procurement to operational delivery. The decision to field three parallel systems accepts initial integration risk in exchange for faster readiness and greater long-term flexibility.

This approach may serve as a test case for NATO-aligned states with similar gaps and timelines. If successful, it could inform next-generation rapid-acquisition frameworks across the Baltic region.

Assessment

Copenhagen’s tri-system procurement represents calculated acceptance that traditional European defense acquisition processes cannot meet contemporary threat timelines. The model prioritizes capability availability over cost efficiency, reflecting strategic environment shifts requiring immediate rather than optimal solutions.

Success depends on Denmark’s ability to rapidly mature BMC2 integration while maintaining individual system effectiveness. The approach may establish new European procurement precedent if operational deployment demonstrates capability advantages outweigh integration complexity costs.

Related Reporting

Editorial Note (10 June): Added Engagement Envelope Visualization